Tiff Macklem, Governor of the Bank of Canada, answered reporters’ questions on the central bank’s policy outlook. This followed the recent BoC’s decision to keep its policy rate at 2.75%, which was largely anticipated by the market.

We see signs of underlying upside pressure on inflation.

The US trade policy remains unpredictable.

We’re looking at a shorter horizon than usual.

The Canadian economy is showing signs of resilience

This section below was published at 13:45 GMT to cover the Bank of Canada’s policy announcements and the initial market reaction.

In line with market analysts’ expectations, the Bank of Canada held its policy rate steady at 2.75% on Wednesday.

The Canadian Dollar (CAD) remains on the defensive in a context of persistent USD buying, with USD/CAD navigating the area of two-month tops beyond the 1.3800 barrier following the BoC’s decision to leave rates unchanged.

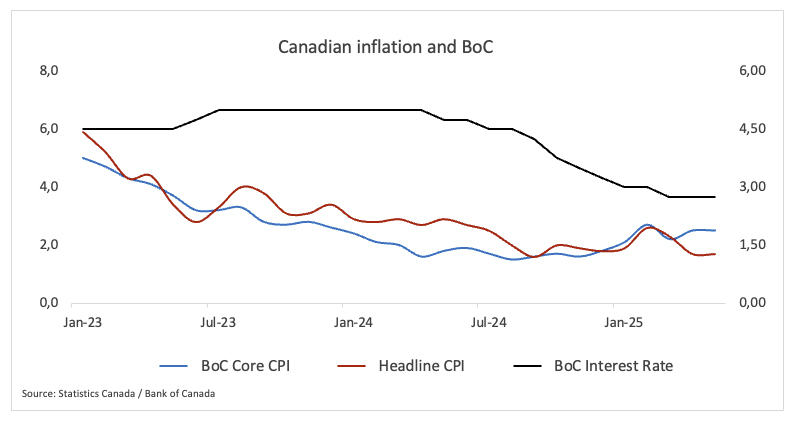

As the Bank of Canada (BoC) gets set to issue a new interest rate decision on Wednesday, July 30, there is a growing sense that the cutting cycle might have already ended.

The BoC decided to keep rates steady in June, citing a Canadian economy that is “softer but not sharply weaker” and noting “firmness in recent inflation data.” Indeed, the policy rate stands at 2.75%, which remains within the bank’s estimated neutral range for interest rates, set between 2.25% and 3.25%.

Previewing the BoC’s interest rate decision, analyst Taylor Schleich at the National Bank of Canada noted, “There’s growing momentum around the idea that the easing cycle is over. We disagree, and we don’t expect the Governing Council to validate this more hawkish view. Instead, they’re likely to keep guidance unchanged, reiterating that they’re proceeding carefully and monitoring the same four indicators: export demand; tariff impacts on investment, employment, and spending; inflation; and inflation expectations.”